New Kid On The Block

Who would have guessed that the most attractive currency in the world could be something that you cannot touch, taste, smell or hear? In fact, you cannot physically experience it outside of seeing it presented on a digital screen.

Cryptocurrency is not yet the most powerful currency on the planet but as people become familiar with the circulation of bespoke non-physical coins, it seems to be heading that way, ultimately killing the dollar and decentralising the money system. But this will not be immediate, the Queen B on the block is Bitcoin and she means different things to different people. As she flirts with investors and anarcho-capitalists alike, they all seem to want a bit as you will come to see.

•

What’s All The Fuss About?

I have often pondered on how today’s world of escalating dishonour, in every facet of trade, could revert back to good old trust. Suddenly from the most unlikely place, my questions are answered: a catalyst for change in the form of a virtual coin.

So what have we done to deserve this? Less than nothing really, I guess the heavens showed mercy and an opening for those of us who actually want a fairer world of trade. Or maybe it is a curse as well for those who get paid from the imbalance. Either way, all we really need is a little gratitude, to say thank you and to make sure that the security of cryptocurrency and the integrity of the blockchain is upheld as a standard for mankind; hopefully, before the extremists succeed in resetting this crooked world. It is indeed a very, very, big thing–even if you don’t know it yet, you soon will.

In 2010 I was baffled by the concept of e-gold so I became curious. Virtual gold-backed by real gold? How can you trust it, who, what, where, why? I was lead to discover that people were beginning to use an alternative currency called Bitcoin. Immediately I thought that this may be the beginning of my ideal–a world of unregulated, adult (albeit consenting) free trade. Being a traditionalist at heart, a currency that you cannot touch seemed well abstract and wasn’t easy for me to accept, but on the other hand, a currency owned by the people: understandable.

All this caused me to delve deeper into a more abstract concept called cryptocurrency mining which basically involves virtual miners (manned computer hardware) solving a digital request in the form of an algorithm and a complex equation verifying transactions on a blockchain. With this done successfully, the miner is remunerated in, the digital currency, Bitcoin. The request and the whole premise is normally aimed towards verify a ledger entry–simple, not.

Even after reading numerous articles, and watching as many videos, it all still made no sense to me. In fact if you have never even heard of crypto, Chinese may be easier to grasp. My interest was destined to go MIA after realising the amount of processing power needed to generate a substantial amount of Bitcoin (more here); it was an investment that I felt was too expensive, time-consuming and risky; it didn’t quite weigh up.

Fast forward five years, I only recently returned as, what I call, a late/early lazy-adopter as this was just before the period of mass awareness–2016 to the present. My interest soared. I now see that I was clueless and still am as to how many fresh possibilities cryptocurrencies offered, it’s almost a sin not to know.

Waking Up

Although much about this new type of money has become common talk, I still couldn’t grasp a full understanding of it. I put this down to the complexity, the huge scope of this money of account thing, the volatility and the many huge unanswered questions surrounding it. But now, I think it’s safe to say that four years on, many of the initial issues, such as the convenience and transfer times, have been addressed with its natural evolution. By the growing amount of startups and the thousands of crypto exchanges emerging online right off of its back, you can see that the world is shifting.

But our awareness is still minimal. Well, at least of the worldwide impact cryptocurrencies and the Blockchain is having on today’s financial institutions and the suppression of the fact that the world is about to change forever; China’s attempts to sink the new heavyweight currency by limiting its usage in China is probably the best evidence of this. Meanwhile, others follow in their footsteps with hopes of killing her but in the most organic way, making it appear as though she died of natural causes. But we cannot be surprised, we should know by now that every plutocracy, by its many names, will do all it can to assassinate any semblance of competition let alone an equaliser or, as I like to call her, the saviour of justice.

Appeal

The main thing that captured me was the idea of using a kind of cruise control money freely without a central bureaucratic body dipping in for it’s cut. After all, these forkers have a policy of taxing every God-given thing that nature provides for us–the earth’s natural inhabitants, from the ability to travel without tolls and cross-examination, to the monetisation of natural elements and monopolisation of innate skills by a bogus system of insurance benefiting from malpractice.

Imagine how many legitimate healers have been suppressed from expressing their divinely bestowed gifts on the needy, just because they can’t pay to get qualified by the regulation drunk authorities’ standards.

False Evidence Appearing Real (rant warning)

I’m sure there are a number of honest farmers who cannot afford organic stamps and credits, who are so far from knowing their personal power or recognising that earning remuneration for their service is their actual human right. But, so broken in spirit are they that they just sit and wait for permission due to a crippling fear of breaking the law and their ignorance of jurisdiction.

By using and recycling fear and the fact that people need to feel safe, the regulatory boards have exceeded reason with their rules, at the same time creating stress, imperceptibly marching communities into ER on a daily basis. But hypocritical to the rule, no regulation has lowered our quality of life like the FSA (Food Standards Agency), who allow harmful ingredients to exist within the, once healthy people’s, supply chain. This not only applies to food but also education or government.

To some corporations, their concern for public health is far less than the profits on the sales of their Warfarin and Oxaliplatin drugs.

Grooming politicians to introduce foreign policies that harm the locals and benefit the investor is not what you would want to call fair trade, in a common market or a united nation; well, at least not in any natural mind.

In Securities We Trust

But we aren’t in our natural minds, are we? What chance does cryptocurrency have when our unaddressed insecurities give us a media parroted opinion without research. Sometimes dropping bogus information on our peers spreads fear deeper into those vulnerable minds. Such has been the case with the esoteric ‘crypto’.

So it’s likely that the fractured minds of ‘we the people’ are the ones that will succumb to the fictitious rumours and play the biggest roll in trying to bring down the unfamiliar, new coin on the block through this farmed fear.

From within that fear, the sentiment is echoed ‘Better the devil you know’ as we automatically seek to police, what could be, our own salvation. Such is our faith in a failed system, even at its very end, with the potential of something fair and new, we still arrest this potential.

Bit What Now?

In November this year (2018), the CEO of Morgan Stanley, James Gorman said: “Cryptocurrency doesn’t quite deserve the attention it’s getting”. This is after (just two months earlier) saying that he thought Bitcoin was “certainly more than just a fad.” This illustrates the attitude that most investors have developed with Bitcoin: a love-hate relationship. Because so many people are in bed with her and she won’t show special preference to any of them they’re taking it personally. She’ll enthrall anybody who’ll put their politics aside and dip their hands into their pockets for her.

Unlike the dollar and the federal reserve, she works alone and will accommodate individuals (and countries alike) with no care for how they look, sound or act. In fact, Bitcoin isn’t really the problem it’s probably the insecurity of bwankers that is the issue we need to carefully observe. They’ve sampled her, fell in love then found that they cannot control her so they’ve decided that she must die! Meanwhile their tech teams work extra hard at creating a faux version, a kind of Apple-microsoftie pad thingy.

Being so used to pimping cash by centralising its flow, starving a country or two here and there, every measure is being taken to get her into bondage like all other currencies. When it’s finally known that Bitcoin is not for private sale, she’s actually from a clean background and is really a question of our own values, we may stop wasting time with the insults, they’re self-harming.

Designed For the People

One thing’s for sure, the Blockchain was not designed to be controlled by any one organisation, so you had better be preparing for a different world.

We will not be going backward from this point. The key fact that we need to know is that every radical mind with ideas of a fairer world is busy working within the Blockchain, choosing the world they wish to create. That’s why you keep hearing the word ‘decentralised‘. Knowing this, our trusty media owned government offer crypto options that look and smell like her but weight the same as fools gold running on rather a bogus, centralised blocked chain. Remember these guys can withdraw funds and wipe out whole countries at will with their remote money.

Judas

Ultimately what this means: is that as the world decides on which cryptocurrencies to adopt, media campaigns are being tailored to steer us into accepting the ones that governments can breach, making it possible for Bitcoin to fail into the hands of the illu… centralised world tyrants. But that’s an impossible feat if ‘the people’ ignore the current smear campaigns and stand by their new quean.

Alternatively adopting a new centralised government-issued coin will allow the issuers to lawfully acquire Bitcoin along with her future profits that were willingly abandoned. In another way ‘…they will buy up the profits from the saviour that we helped them to crucify’.

If we can cast our minds back to America, 1933, Executive Order: HJR 192 under F.D. Roosevelt; we will see that governments often decide where the people should find value and the media naturally assist the cause. The citizens of America had their gold taken out of their clutches and exchanged for bills conveniently around the time of The Great Depression or even more conveniently the Great Gold Haul.

It’s not too far a stretch of the imagination to think that this could easily be repeated on a global scale by the takeover of the primary crypto coin or by simply pulling their final hand–the law, deeming all trading in Bitcoin and other currencies illegal while still holding on to our crypto. All because of it’s threat to the dollar.

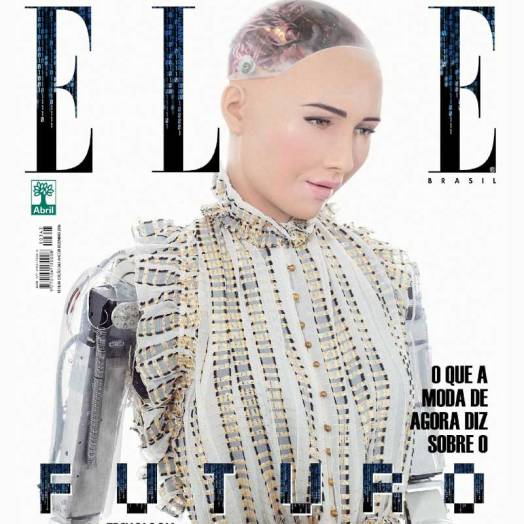

Meanwhile online, the rumours keep coming. One such rumour suggests that Satoshi Nakamoto (Bitcoins creator) isn’t a real person but really just an anagram made from four major telecommunication companies’ names, adding doubt about her ethics and intentions amongst the already confused world. Then there’s other talk suggesting that Sophia, the first Saudi Arabian robot citizen (oh God!), masterminded the whole thing. The spread of this useless fear satisfies only those interested parties of war-funding dollars.

To draw a parallel: it’s like the oil companies fighting to exist in the presence of the electric fuel revolution or maybe even genetically modified sci-food over organic food. It seems pathetic that a drug company can fight against natural herbal medicine in plain sight of the masses but this is what we allow.

We may be witnessing a fight going on between good and evil. But it’s a game of monopoly where the winner will not be the one that exerts the most force but exercises their right to simple non-participation in the unhealthy. The major corps need the people to accept these rules to profit their sponsors but a simple ‘no’ could mean everything. To want to share your shares amongst the people and attenuate the bank will change the game forever. But there will be compelling incentives to test us. We should not be surprised that these offers will hide behind ethical looking media groups, ICO‘s and cryptocurrencies alike.

In September 2017 Jamie Dimon, CEO of J.P. Morgan said, ‘I’d fire a J P M trader in a second who traded that. It’s against the rules, it’s stupid, it’s dangerous’. This was in reference to cryptocurrencies and was stated when the banks started panicking after taking notice of crypto’s profitable rise and the inevitable threat to their financial system. The comment seemed emotional, desperate and a little less calculated than the deeper, Edward Bernays style, psychological attacks that the media are dishing out today.

Dimon later went on to say that he ‘regrets saying this and believes in the technology behind it’. J. P. Morgan Chase have since announced the launch of a blockchain based system. It’s hard to believe that a decentralised system can come from such destabilised views.

The Cavalry

Knowing the deeper message of the currency, it seems sensible to assume that those who fight against it with such venom and misleading words like ‘bubble’, ‘hoax’ and ‘crash’ and attach fraud, drugs, terrorism and money laundering to her are more likely to be the same criminal minds benefiting from the same crimes in a different name, on different shores. I fail to remember when the dollar curbed participation in these ongoing major crimes. But please take note of this attitude for in the future we will live to see these corporations hiding amongst the crypto advocates.

It’s becoming increasingly obvious how all the negatives at the centre of cryptocurrency news conveniently leave you feeling doubtful and confused, highlighting an agenda to crucify the saviour. Its decline could only aid those who have something major to lose on the outside and are possibly allergic to honesty. Ultimately we all fail to recognise and support the huge security benefits that Bitcoin has to offer.

The Block

The Blockchain is like the horse that Bitcoin pulled up on. It’s the back-end system that the cryptocurrency sits on and in as much as it sits on such an honest ledger system, the accounts are pretty much un-hackable. You would think this would strike fear into the criminal mind but it’s actually the governments and the banks that are most scared.

It’s almost like Colonel Mustard is looking pretty nervous right now after pointing at Mr.Green for all those years; because this technology could mean, in essence, total accountability and no hidden spending, arms deals, misappropriated funds, toxic loans or ghost contractors on the part of the government. It’s very transparent and almost an alien in this deceptive world that we have become accustomed to living in. You would expect it to be embraced with both arms but the tabloid dependent world doesn’t like it one bit. And the rest of us–we get it.

The Plan

It would be nice to see this defender of liberty embraced and protected by women. I feel that a nurturing essence at the beginning of this major game change may protect it without the prejudice of overambitious testosterone. As flipped as our world may be, the organic nature of women still seems to be to prioritise and conserve life and not to destroy, force, rob, modify, blow up, poison, extract and whatever other mischievous ventures men will engage in to support their grand illusions of power.

I’m noticing many more women adopting the philosophy of the new cash and I hope this will inspire a sisterhood to replace the macho brotherhood and all of their harmful devices. This isn’t an attack on men but on that antiquated patriarchal state of mind that knows only the word ‘take’.

In 2014, Bitnation was founded by Susanne Tarkowski Tempelhof. Her ideas were formed around her father being stateless for a decade and witnessing unethical and non-sustainable governance during the Arab Spring. Her desire to create a more fluid communication between the people and the system, promoting the power to choose in all aspects of living and government, in particular, led to the creation of Bitnation.

Bitnation has an ethical, nurturing core and seeks to simplify the contractual communication between different parties for a more sound resolution without centralised interference. The heart behind Bitnation is just a small example of the world that the Blockchain and its cousin Bitcoin are forming from the new young minds that actually get what this actually means to equity.

Who Knows?

“Give me control of a nation’s money and I care not who makes its laws” — Mayer Amschel Bauer Rothschild.

Well, not exactly. To that end, cryptocurrency says, ‘you keep your money and we’ll keep ours’. As shrewd and intelligent as Rothschild’s statement sounds, I feel the quote is less worrying than it seems to be at first. In the information-hungry world that we live in today, the real concern is total control and amalgamation of all media groups.

With the public’s trust in these information distributors, whatever they suggest will have a huge impact on public faith, having a direct influence on our lives. It’s fine if people remain dependent on the amalgamated press but we should recognise that what they don’t know can often harm us.

We should be aware that our confidence in the new coin will expand and contract as the press sees fit as we’re conveniently, continuously swayed. We will continue to be warned of the illegality and all the negative impact with the appearance of this Christ that judges all equally. They will keep bringing up Ross Williams Ulbricht and his den of illegal trade: Silk Road, as though Bitcoin was the point where crime came into existence.

There is also need to be aware of those calling themselves cryptocurrency experts. It’s no secret that the old world money ‘experts’ (again) aided by the media make damning predictions regarding what they think will happen with local and foreign economies, their media then distributes the fear while we automatically turn their prophecies into our reality. We could get into the chicken or the egg argument here but let’s stick to the point.

They will pop up from the old world of finance with their paid reps to appeal to our urban-ness dressed in fatigues and Vans, hosting cryptocurrency talks to represent your saviour but in their own way, for their own benefit, pushing their consortium of private blockchains which are not totally decentralised.

But the yesterday experts should be handled with caution as they are opportunistic novices in this arena and by their nature they seek a federalised blockchain, contradicting the whole idea of freedom.

Let’s remember, those cash billionaires of yesterday–the types who invest their money in war and GMO crops behind helping third world countries, have not a care or a concern for human life and can easily afford the biggest platforms to spit their agenda’s. And if you, like most others, do not look past the first page of Google, your sense of reason is at the mercy of their commissioned articles sitting at the top and right of your browser page.

Stocks And Stones

There are very simple things to comprehend before we go all anti on the very thing that’s killing the dollar and breaking the unforgiving, systemic chain around our necks.

One is that: It’s a problem to the banks and all those who feel they have a controlling grip on money. As we sleep, there are corporate think tanks with more money than combined countries, assembling and desperately trying to find new ways to bring Bitcoin down and regain control.

They will naturally use the media and morality as the tool to do so as it has worked incredibly well in the past. But what happens when the media itself is set up on a blockchain network and those questionable quotes and opinions are attached to the author with their permanent signature and full liability for the disinformation, with all links to the sources of their lies, nobody wants that?

We should understand that transparency is transparency and if the government (for lack of a better word) can no longer hide and are made accountable for their local and foreign interactions it will naturally dissolve. So what? It’s not in our best interest to put our governments on life support when it serves itself first. At its very core, it is not really the friend of freedom.

By all means, try but one way or another it’s time stamped and, as painful as it seems, cryptocurrency is the catalyst that neither a theist nor atheist saw coming to set the record straight. Like it, lump it, get in or get left out but it is certainly a change in power that nobody could have seen–a digital judgment day.

About The Saviour

But we don’t all see things in the same way. The media isn’t the only issue. Although some deists are adopting the Christ Coin, others are more than happy to hold their breaths waiting instead for a saviour, looking suspiciously like Ptolemy, to pop up in sandals, robes, and a Louis Vuitton halo to sort out this economic funk.

There’s also the atheist sitting in hope that trusty Steven Hawkins will think overtime and identify a reachable rock inside of a Goldilocks zone somewhere in the heavens to propel them through space, only to start screwing up another organic solar system. All this dependent on god particle dimension-manipulating, technology that science says doesn’t really exist. I mean is it possible to find God’s system without believing she exists?

And of course, there’s the rest, taking both the views as non-literal metaphors and looking to find the sun of God in helio-space exploration while seeking Christ in technology. And Oh! has she returned.

Herstory

At the beginning of the millennium, BBC (before bitcoin), the Limewire BitTorrent popped up as an early Peer 2 Peer system using the Gnutella network. It was my first introduction to decentralised p2p. Imagine, rather than the long-winded act of searching various websites to get to a file online you could simply extract files from another computer, anywhere in the world, using a torrent only as a bridge to connect the two computers together, with full encryption, all in one location. This was really the birth of decentralised online trade. As it grew the benefits far outweighed the risk which were: simply to cut out the middle-man (browser), it was much quicker, anonymous and pood on regulations.

Unfair, you may say, especially with intentions of piracy but in the way that today’s blockchain/cryptocurrency works, the intentions are freedom and convenience and you will see this common theme with those who generally take an interest in cryptocurrencies and/or Blockchain technologies. The security is already built into the code, so that’s one greedy go-between that is no longer necessary.

If you doubt its exigency I suggest you look at how trade security regulations benefit only privileged groups with no real concern for the meekest of our humankind, leaving everyone but the privileged on the outside.

Unless you work a 9-5 for enjoyment alone the blockchain and its unique type of sharing may not appeal to you but if, like most others, you have to work to put food on your family, (to quote the first jester in office George W. Bush), keep the roof over your head and avoid poor health, you need to study the wonderful possibilities of this revolution; it puts the power in your hands and will balance the books with certainty and they know it.

In 2008 the domain Bitcoin.org was registered online. Later that year a bitcoin whitepaper on a Peer-to-Peer electronic cash system was posted to a cryptography mailing list by Satoshi Nakamoto. In 2009 the first block called The Genesis Block was mined by the author. In 2010, Nakamoto handed the network alert key and control of the Bitcoin Core code repository over to Gavin Andresen, who later became lead developer at the Bitcoin Foundation. Shortly after that Nakamoto disappeared and was never heard from again although, in reality, nobody had ever physically seen him. Andresen claims that it may have been after he told him that he had a meeting with the CIA. Well, who could blame him?

To this day nobody can confirm whether the individual, Satoshi Nakamoto, ever existed outside of a pseudonym. I would be inclined to entertain the rumour that this Bitcoin thing was the government’s idea all along if it wasn’t for the fact that Bitcoin rests on the blockchain that, as a ledger system, allows no room for foul play.

So if the creator of Bitcoin, be it man or a machine, had government ties then they’ve created a tool to wipe out deception and quite possibly the government as this contradicts the ethos of government that exists to resolve conflict, now investing in conflict to justify its presence and remain significant.

This more socialist angle shows that if it were the government, it shot itself in the foot as each blockchain user is on a transparent ledger of transactions, a one size fits all situation that can only benefit the whole and eliminate contention.

Yet still, somewhere outside of mother nature’s cosmic order, this blockchain thing poses a problem to some mature men in small private clubs, whose white hair may as well be bum fluff for it means nothing to their moral views of the world. They stand to lose a whole lot when cryptocurrencies secure their place in trade history and they are putting hard money into its fall. At the same time investing in it, fearing they will have to try to control it too one day soon.

Even a child would hope that having endured decades of life lessons would grow out of that experience a sagacious soul that would rather lose everything they have in order to see the world with a fair system of barter, simply because that’s the way it should be. Yet these toddlers in big grey clothes would rather the world lose everything it has–people, vegetation, water and fresh air too–for them to keep a grip on the planet’s faux system of trade. What a suspicious, heavy karma-baring ambition.

Their overall investment is in the segregation of people, the spreading of fear and the satisfaction of knowing that the world community will always be divided and steered by their media. They’ve unwittingly created this digital trade, so in an impalpable sense, it was created by the government as an answer to their relentless greed.

Ironically, the legacy that they will share is only to make one thing certain: The word ‘Banker’, that used to describe a worker at the money storage place, will one day be a rude entry in the Urban Dictionary.

Final note

With the world trying to phase out Bitcoin and China’s ban on Bitcoin mining within China, the fact that they mine 60% of Bitcoin, it makes sense that the ‘Ban’ may well be an attempted takeover. Especially as 51% unified mining means a coup. A government can hijack the mining operations to ends I can’t even bear to imagine.

phase something out

(Definition of “phase something out” from the Cambridge Academic Content Dictionary © Cambridge University Press)

By Angel Lewis

For the Telegram groups: Bitcoin UK & Bitfriendly meetup and the helpful dialogue that shaped much of this article. For Colonel Gaddafi and his vision of a fair decentralised economy. RIP